Dean Baker of the Center for Economic and Policy Research, writes that future generations can afford higher Social Security taxes, so long as reduced earnings inequality means that their annual incomes will rise.

Occasional comments on the economics and politics of Social Security policy by Andrew Biggs.

Dean Baker of the Center for Economic and Policy Research, writes that future generations can afford higher Social Security taxes, so long as reduced earnings inequality means that their annual incomes will rise.

4 comments:

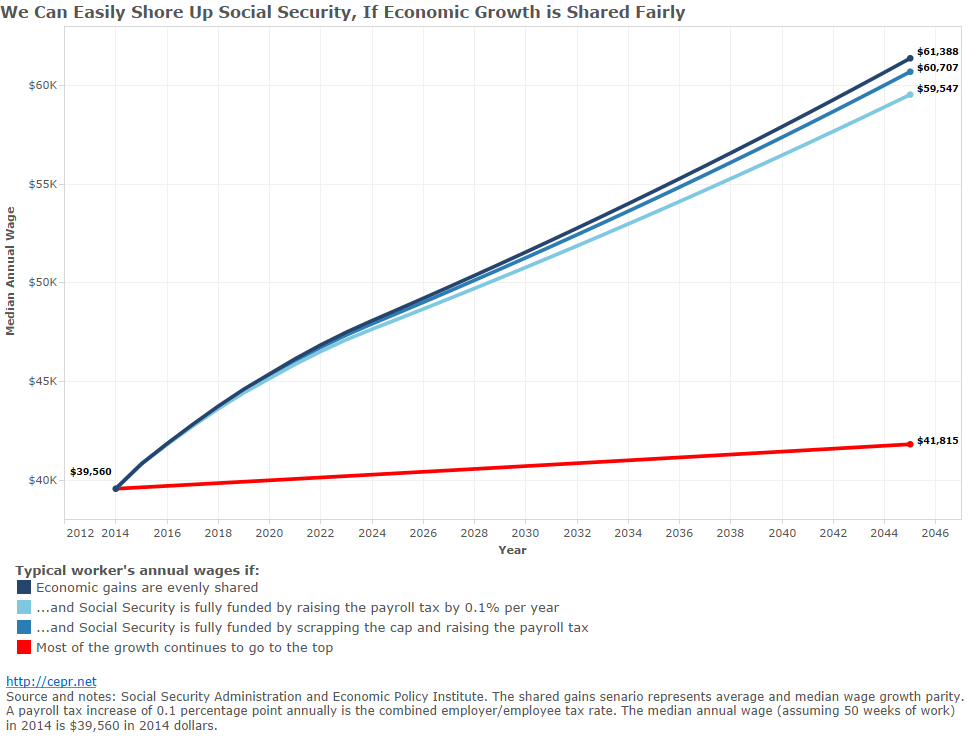

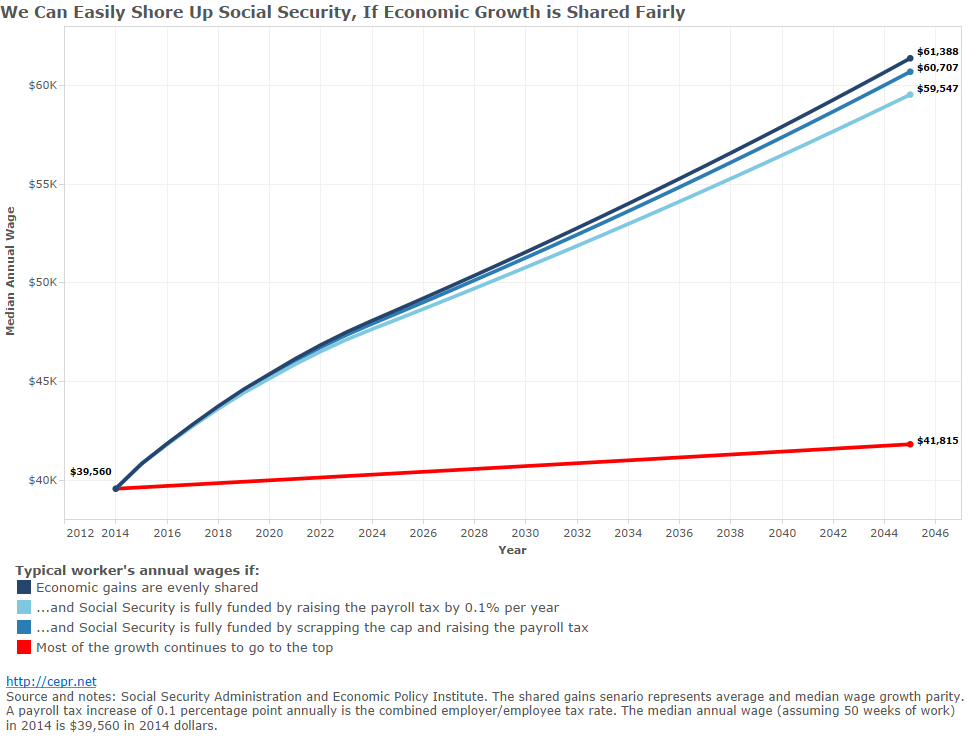

"If we see the sort of wage growth projected by the Social Security trustees, and if it is evenly shared, then real wages would be 55 percent higher in 2045 than they are today—a $61,388 median annual wage compared to $39,560."

What Baker fails to appreciate is the 1977 OSI benefit formula. As wages grow, so does the future benefit. Bend points increase, SSA wage index table increases and thus the initial OASI benefit.

Suppose that we close the projected shortfall in Social Security entirely by raising the Social Security payroll tax, with no other revenue increases and no cuts in benefits. In this case, our children would see after-tax wages that are 51 percent higher than what we earn today, with a median wage of $59,547.[1] It’s hard to see the generational injustice here. (It is worth reminding those who consider this tax to be a generational injustice itself that we now pay a far higher tax rate than our parents or grandparents did.)"

Wage growth is a very good measure of the standard of living. In essence Baker thinks future generations due to their igenuity, hard work, dedication will be glad to part with most if not all of their hard work in the form of higher taxes. Baker would suck the force that drives us to do better right out of the economy.

"Most workers have not been seeing real wage increases in the last three and half decades. This is because most wage growth has gone to those at the top: CEOs, Wall Street bankers, and highly paid medical specialists."

Baker has little concept of relative size. Yes CEO's make a lot, but if distributed to workers instead, the increase to each worker would be minimal. As an investor, I seek out companies that have strong leadership. I am willing to support paying a CEO who does an excellent job. However, there have been many companies buying back stock shares with borrowed money due to the low interest rates today. Demand growth is not great due to lower population growth. China has over built and under utilization of existing infrastructure - the world has an over capacity to build.

As an investor I want a return. As a worker, if I want to share in the companies success and growth, I need to invest it the company. A worker is paid for their services. If they are unhappy with that, they can find another job. However, if there is a surplus of labor, then like oil surpluses/over capacity, prices fall. Artificial changes to the supply/demand creates problems. Just look at quantitative easing. Did it do any thing?

If you want workers to participate in the American Economy, then they must be allowed to choose that. Clearly my parents and their generation did and were able to because they paid life time payroll taxes that were substantially less than today's workers. Payroll taxes keep a family from creating wealth.

Baker: "then real wages would be 55 percent higher" and "In this case, our children would see after-tax wages that are 51 percent higher.

Larsen: "will be glad to part with most if not all of their hard work in the form of higher taxes"

According to Baker our children will have to dedicate 4% out of a 55% increase in order to retain scheduled benefits. This is certainly NOT most or anywhere close to all of their hard work. A bit of an oops in the reading there.

Myth

The initial Social Security benefit is based on average lifetime-indexed wages. Wage

growth is used to adjust past wages of future retires; similar to inflation being used to adjust social security benefits for current retires. When rate of economic growth, and its resulting increase in wages, exceeds the rate of return on the social security trust fund, then social security is actually disadvantaged due to economic growth. For example if wages were to rise 5% this year, the initial social security benefit for

future retires would also be 5% greater. If the trust fund investment returns did not match or exceed the 5% rate of growth then the trust fund would be falling behind on its ability to meet the pay out commitment.

In simple terms economic growth will not save Social Security and in technical terms,

increased economic growth makes funding social security worse. [3]

Myth 5

Productivity growth is what is needed to save Social Security Social Security revenues are based on wages earned by the worker. Productivity can contribute to real wage growth (see myth 4) and/or the displacement of workers. Both of these conditions reduce social security revenues. Productivity growth will not help at all.

What Arne and Baker do not realize is that increased wages produce increased future benefits at the same identical rate. What Arne and Baker would like to see is future workers returning/reducing their increased standard of living to those who supported Social Security for decades with votes, but not with their own payroll taxes.

Dean Baker wrote “Inequality Is the Threat to Our Children’s Living Standards, Not Social Security Taxes” has proposed that future workers 50 years hence from now will have wages that are 55% greater than today adjusted for inflation. Baker than asserts that future workers real wages will be higher and therefor able to allow higher payroll taxes while still allowing works to maintain their standard of living.

Those pushing to cut and/or privatize Social Security have long tried to rest their case on an appeal to generational equity. They argued that the taxes needed to support baby boomers would impose a crushing burden on our children and grandchildren.

This argument flies in the face of reality. If we see the sort of wage growth projected by the Social Security trustees, and if it is evenly shared, then real wages would be 55 percent higher in 2045 than they are today—a $61,388 median annual wage compared to $39,560.

Suppose that we close the projected shortfall in Social Security entirely by raising the Social Security payroll tax, with no other revenue increases and no cuts in benefits. In this case, our children would see after-tax wages that are 51 percent higher than what we earn today, with a median wage of $59,547.[1] It’s hard to see the generational injustice here. (It is worth reminding those who consider this tax to be a generational injustice itself that we now pay a far higher tax rate than our parents or grandparents did.)

History may not support this perception. The SSA National average wage indexing series, 1951-2013, found at www.ssa.gov/oact/cola/AWI.html compared to the CPI index found at www.bls.gov/cpi/#data allows us to look at 50 year changes starting in 2001 through 2013.

62 years were evaluated of which in 40 of those years, wage growth was greater than the cpi or 64.5% of the time. From 1951 to 2001 the United States saw a reduction of live births one year later.

Years 2001 - 2013 show the real wage growth over 50 years. During this period of time, the last 13 years have shown real wage growth of over 140% greater than they were 50 years ago. However, it should be noted that since 2001, the 50 year change has changed from 183% to 140% in 13 years.

With the reduction in birth rates per woman starting in 1961 (the pill) and increasing in 1973 (Row v Wade) the birth rate is now 2.1 per woman. This is considered zero population growth. Real economic growth is achieved by productivity and increased demand. Productivity is driven by a scarcity and demand exceeding supply. With a reduced population growth, the need for increased productivity to produce the same goods and services today with be less than during the period of 1951-1983.

However, the question that remains unasked is why when the growth in wages from 1950 to 2013 increased the standard of living was not the “taxed” to avoid the problem today? Clearly the growth rate during the past 63 years was far greater than that projected for the next 50 years. If workers with families are struggling today to make ends meet financially, then how does increasing the payroll these same workers allow them to make ends meet in the future with lower wage growth?

Dean Baker is attempting to misdirect the root cause behind social security and to patch the symptom by raising taxes on workers that have already paid significantly more than any other generation by more than 100% and for lower benefits.

50 YEAR GROWTH

Year Wage cpi 50 year real wage growth

2001 1076.1% 589.4% 183%

2002 1018.3% 568.3% 179%

2003 985.1% 583.1% 169%

2004 1029.7% 588.5% 175%

2005 1019.3% 614.2% 166%

2006 994.2% 639.9% 155%

2007 1009.5% 633.4% 159%

2008 1025.1% 638.0% 161%

2009 955.9% 628.1% 152%

2010 940.0% 639.5% 147%

2011 951.7% 639.0% 149%

2012 932.8% 655.6% 142%

2013 921.0% 657.5% 140%

Post a Comment