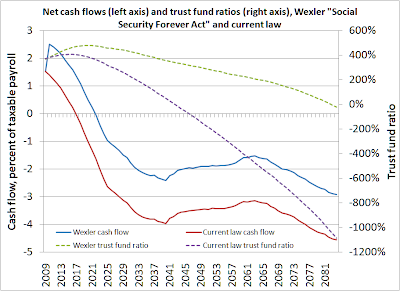

Florida Rep. Robert Wexler reintroduced his "Social Security Forever Act," which would impose a 6 percent surtax on earnings above the taxable maximum of $106,800. The tax would be split evenly between employers and employees, and no additional benefits would be paid based on the extra taxes. Off the top of my head, this would increase Social Security's revenues by around 1 percent of payroll, since around 16 percent of total earnings are above the current wage ceiling and Wexler would tax 6 percent of them, which equals 0.96 percent of payroll. Using the GEMINI microsimulation model I simulated the effects of Wexler's plan on Social Security solvency. The chart below shows both the system's net cash flows and its trust fund ratio (the trust fund balance divided by that year's benefit payments), both compared to current law. Trust fund solvency is clearly what Wexler was aiming at here, as the trust fund ratio would remain positive throughout 75 years but become insolvent soon thereafter. However, this plan doesn't approach so-called "sustainable solvency" in which the trust fund would remain healthy after 75 years. Moreover, the plan depends on building new trust fund surpluses today to help finance deficits in the future, the same philosophy taken in the 1983 reforms. There's not much point in belaboring the problems with that approach. Annual cash flows, while better in every than under current law, still run pretty significant deficits beginning in around 2022, versus (we think) 2017 under current law. I'm not sure a trust fund-based approach is going to be that effective in truly prefunding future cash flow deficits, but at least Rep. Wexler has the guts to put his plan on the table – which is more than can be said about most Members of Congress, Republicans or Democrats.

Friday, April 3, 2009

Wexler reintroduces Social Security (almost) Forever Act

Labels:

payroll taxes,

Social Security reform,

taxes,

Trust Fund

Subscribe to:

Post Comments (Atom)

1 comment:

Andrew, you are correct about the 75 year solvency period. In fact the 6% proposal does not even achieve payable benefits under current law for 75 years. To achieve this requires 2%.

“...the 75-year time horizon is arbitrary since it ignores what happens to system finances in years outside the valuation period. For example, we could eliminate the actuarial deficit by immediately raising the payroll tax by 1.86 percent of payroll. However, as we move one year into the future, the valuation window is shifted by one year, and we will find ourselves in an actuarial deficit once more. This deficit would continue to worsen as we put our near term surplus years behind us and add large deficit years into the valuation window. This is sometimes called the "cliff effect" because the measure can hide the fact that in year 76, system finances immediately "fall off the cliff" into large and ongoing deficits."

The simple truth is the payroll tax simply for a pay-as-go program is very close to 19%, up from 10.6%. This is a 79% increase in the payroll tax for no increase in benefits.

The current targeted benefit of 42% of lifetime indexed average wages is worth less than a 6% payroll tax.

For those who think raising the payroll tax is ok, what do you think about the price of gasoline? From $2 to $3.58 a gallon, but instead of only being 4% of income, it will be 19% of income.

There is no painless solution to this fiasco. The money the boomers have paid is gone (Bernie Madoff). They only way to pay them their benefits is to take it from someone else. It won't be their parents, that leaves your children and grandchildren!

Post a Comment