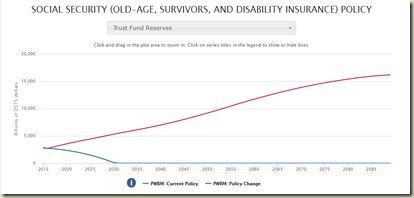

The Wharton School at the University of Pennsylvania has released a new Social Security simulation model that allows users to build their own reform plan. What’s interesting about the simulator is that it’s built on an independent microsimulation model of Social Security’s finances rather than pre-run reforms chosen by SSA’s actuaries. This means that as the model is further developed, additional reform options may become available, as well as outputs on the distribution of Social Security benefits. Well worth checking out.

You can find the model here.

3 comments:

I am not sure why they spent time dealing with productivity. As far as I know the Social Security payroll tax does apply to productivity, but to wages. Now if the purpose was to further approximate the wages of groups, this might be important. However, after looking at the error rate in their modeling of groups it appears that the sum total of all the errors is greater than just using the average SSA wage base times the labor number.

I would model SS-DI and SS-OASI separately - they are different in payroll tax, criteria for drawing benefits and trust fund.

After putting in some values such as decreasing benefits by 25%, the problem comes back 75 years later. Clearly the 75 year solvency period used by SSA is meaningless and provides a misconception of the size of the problem.

It is good some else has built a model.

How is this any better than the simulator at CRFB or at American Association of Actuaries?

These simulators create a false sense of security that the problems of Social Security can be fixed with a Chinese menu of policy options. They also tend to fall out of date as the SSA updates their estimates and the game managers don't.

I'm guessing the model includes productivity as a factor in predicting individuals' wage growth. There's an overall growth of productivity, which affects everyone, but individuals have different levels of productivity based upon education and experience. I think the SSA OACT model also includes productivity as an input to wage growth, though at a simpler level.

The advantage of the Wharton model over the CRFB and others is that it's not limited to policy provisions that have been pre-run by the SSA actuaries. It can run new provisions that they haven't thought about. And, because it's built on a microsimulation model, it should be able to provide distributional results that are more detailed than what SSA could provide (and doesn't provide, in the case of individual provisions versus overall proposals).

Post a Comment