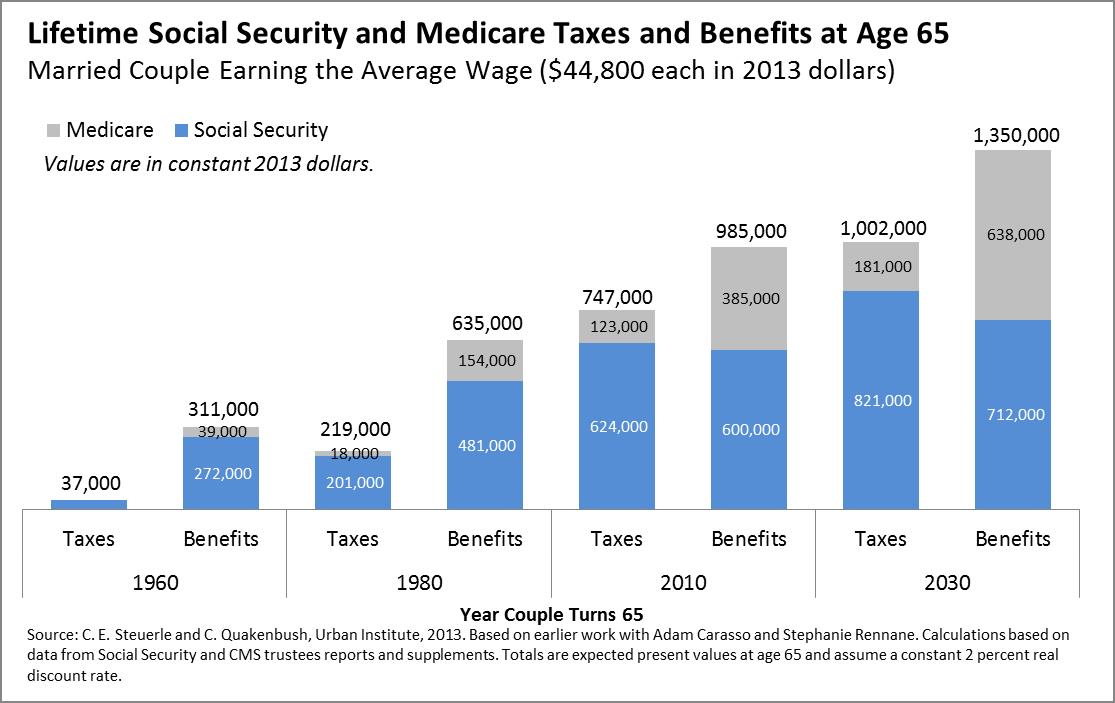

Gene Steurle and Caleb Quackenbush of the Urban Institute have updated their figures showing the lifetime Social Security and Medicare taxes people pay, based on when they’re born, and the lifetime benefits they can expect to receive.

There’s an interesting pattern here: for early cohorts, say the 1960 cohort shown on the left, the real money was in Social Security: you paid a little Social Security taxes and received a load of benefits. Medicare was a bonus: people at that time paid next to no Medicare taxes, but the lifetime benefits weren’t all that much.

Today, it’s a different story. Social Security has turned the corner, both through higher taxes and relatively lower benefits (through the retirement age increase), meaning that a typical person retiring today will pay more in Social Security taxes than they’ll receive back in benefits.

So we’ve saved the budget, right? Wrong. Medicare has grown so much in terms of cost/generosity that a typical person retiring today will receive around $260,000 more in Medicare benefits than they paid in taxes.

Where’s the money going to come from to pay for that? Well, that’s the question…

No comments:

Post a Comment