Several blogs are reporting an update (or perhaps simply the public release) of a 2007 Congressional Research Service policy paper on the transition costs associated with Social Security personal accounts. While any exploration of this tricky issue is welcome, this study – perhaps due to a desire to produce quantifiable results with limited data – unfortunately mischaracterizes the question.

“Transition costs” arise when a pay-as-you-go program is converted in part or whole to a pre-funded program. In a pay-as-you-go system today’s retirees are supported by today’s workers; in a funded system today’s retirees are supported by their own savings, accumulated during their working years.

Any effort to prefund future benefits involves transition costs, be it through “carve out” accounts funded out of the existing payroll tax, “add on” accounts funded on top of the payroll tax, or through investment of the Social Security trust fund in assets other than Treasury bonds. (I will discuss this latter case in a separate post).

But for simplicity, let’s stick to the common example where today’s workers invest part of their payroll taxes in personal accounts. Since Social Security is a pay-as-you-go program, today’s taxes are earmarked to pay today’s benefits. If part of those taxes are invested to pay tomorrow’s benefits, the system face a temporary shortfall. This shortfall, which declines and eventually disappears as workers with accounts begin to retire, is referred to as the transition cost. Intuitively, the larger the amount of prefunding – that is, the larger the accounts and the higher the share of workers who participate – the larger the transition cost.

Transition costs bring with them transition benefits. When workers with accounts retire, the tax rate needed to provide a given level of total benefits declines since part of those benefits are provided by the accounts, which were funded in the past.

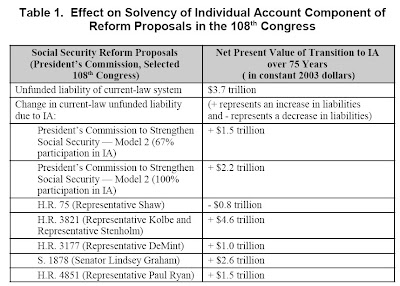

Where things get difficult, and where the CRS report runs into problems, is when we attempt to quantify the transition costs of a given reform plan and compare to other plans. The CRS report defines transition costs as “the dollars put into the IA (Individual Account) by the government [minus] any dollars taken from the IA to help pay benefits over the 75-year actuarial period.”

While this definition sounds reasonable, it encounters several significant problems.

First, in any measure that consistently counts both the contributions to accounts and benefits paid from accounts (e.g., closed group or infinite horizon measures), the measured transition costs for any given cohort of participants will be negative so long as the accounts’ assumed returns exceeds those of the Social Security trust fund. This is simply because the account contributions would be compounded forward at a higher interest rate than they are discounted back at. This is unnecessarily generous to personal accounts: if accounts earn more than the riskless interest rate it is because they invest in riskier assets. In any case, it's not clear how netting benefits paid against account contributions relates to the intuitive view of transition costs.

Second, countering the above methodological generosity is the use of a 75-year measurement period to calculate transition costs. In fact, the only reason any of the reform plans show any significant transition costs is due to measurement using a truncated 75-year period. Net transition costs are driven almost entirely by account contributions made during the 75-year period that are paid after the 75th year. While one can argue about measuring system financing with a 75-year period or the infinite horizon, in this case the 75-year horizon seriously skews the results. And, as above, it’s not clear how this measure relates to the intuitive view of transition costs outlined above.

The problems presented above don’t imply that measuring transition costs is easy. The President’s Commission to Strengthen Social Security presented a measure of “transition financing” that stated:

In every year where financing needs are greater under the Reform Model than they would be under current law, that year is identified as a “transition year.” All required extra financing is added up for each transition year, and the sum is given on the table.

Under this definition, a reduction in the Social Security surplus due to personal account is not counted as part of a transition cost. In addition, if reductions in traditional benefit growth reduce the need for overall financing to the program, this also reduces measured transition costs. Again, it’s not clear that this measure hits on the intuitive notion of transition costs.

1 comment:

Well first of all nobody is going to get traditional returns on stocks and bonds if the economy actually performs down to Intermediate Cost assumptions, you can only squeeze so much out of a model that assumes 1.7% ultimate productivity and 2.0% ultimate GDP. And if you abandon Intermediate Cost growth assumptions fairness suggests rescoring traditional Social Security with the new numbers. Some people out there want to work from two sets of books, one to predict crisis and another to produce solutions. Well no deal. Because we know what one solution would be, Low Cost is out there.

Second there are no real world advantages to the average worker from moving from Pay-Go to pre-funded unless he gets a better deal than the current system delivers. The arguments for PRAs are entirely ideological, in practice the plans I have seen all end up with most or all workers with limited control over their accounts and with the results annuitized, i.e. no Ownership Society. This was certainly true for Posen which the President came close to endorsing and is true for the current LMS: Liebman-MacGuineas-Samwick plan.

The fundamental problems for privatizers are the same as they have been for a decade. One the cost of a tax-based fix is in fact pretty small and interestingly on balance shrinking over time. Currently it is sitting at 1.95% and the challenge is to find some path to delivering a better end result for retirees at less cost than simply accepting the tax increase, in effect the payroll gap establishes a budget for transition costs. For example we know the transition cost for LMS, their plan was submitted and scored by the OACT. The combination of tax increases and benefit cuts adds up to 4.2% of payroll for the average worker and for most doesn't deliver a 100% result.

Since the average worker is not interested in scoring libertarian points at the expense both of the legacy of FDR and their own benefit check down the road privatizers have an awfully tough sell here. I don't know that much about MacGuineas but I know the backgrounds of Liebman and Samwick, if they couldn't find a fix to a 1.95% problem with anything less than a worker financed 5.2% (including cap increase) solution then I am thinking no one can. Workers will need a pretty solid cost-benefit analysis with direct attention to their own bottom line before any of these schemes sell. Simply gratifying the boys at the Chi GSB and the Economics Faculty Room at GMU is not going to cut the mustard with the lunch box crew.

Post a Comment